Report: Single-use Bioreactor Uptake Plateaued, Other SUT On The Rise

By Ioanna Deni, BioPlan Associates Inc.

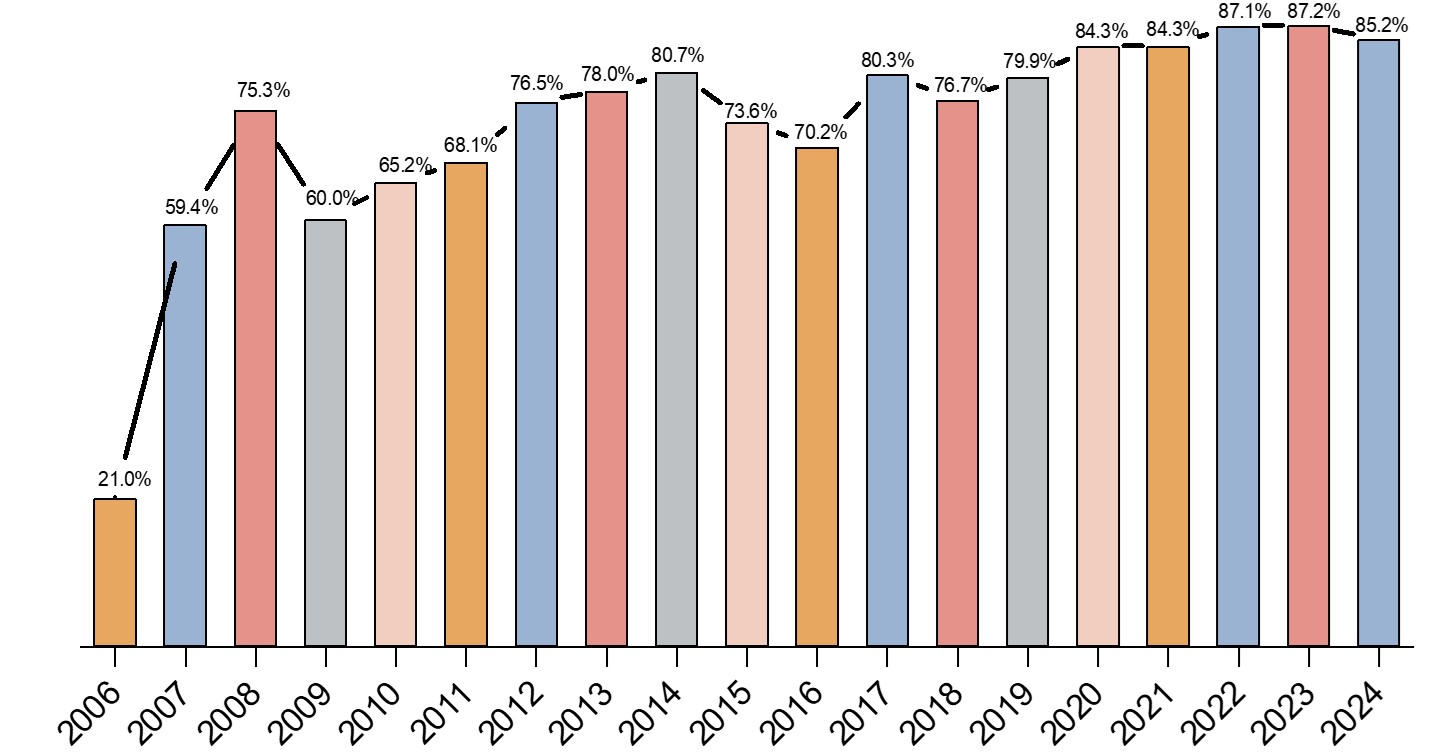

The adoption of single-use systems (SUS) in biopharmaceutical manufacturing has seen a dramatic change over the years. In 2024, SUS usage rates hit 87%, according to BioPlan’s 21st Annual Report and Survey. Although we have seen steadily increasing acceptance of SUS over the past decades, COVID created an environment where the shift from fixed stainless-steel bioprocessing has accelerated. In fact, the average largest bioreactors in use at global facilities has declined since 2017 from 4,718 L to 3,664 L today.

In the early 2000s, the advancements of single-use manufacturing were facilitated by improvements in large-scale tube welders and sterile connectors, which allowed for more seamless connection of sterilized fluid systems while maintaining their sterility. Despite their low usage in the biomanufacturing sector, their introduction, along with larger, more robust bio-containers, led to the creation of innovative disposable rocking-bag bioreactors. These were the first forms of single-use bioreactors. During this period, the Bio-Process Systems Alliance (BPSA) played a crucial role in promoting best practices for the implementation of single-use technologies.

As a result of numerous factors, single-use bioreactors have been adopted across different stages of biomanufacturing. Single-use bioreactors have also created demand for other SUS, including:

- sensors,

- chromatography systems,

- sampling systems,

- fermenters, and

- tangential flow filtration (TFF) systems.

Low market penetration led to a surge in single-use-bioreactor adoption in the early 2000s. As noted, a pivotal moment came with the COVID-19 pandemic, which underscored the need for rapid and scalable production processes in the biopharmaceutical industry. The urgent global demand for vaccines, such as those developed by Pfizer-BioNTech and Moderna, required manufacturing solutions that could be swiftly implemented. Single-use bioreactors, bags, and tubing played a crucial role in meeting this demand, enabling these companies to scale up production quickly without the delays associated with cleaning and validating traditional stainless-steel systems.

However, the rapid growth of single-use bioreactors has reached a plateau in recent years. Their growth rate in 2024 was between 1.6% and 3.5% (CAGR). This suggests that they are still increasingly adopted in the industry but at a much slower rate than before.

For instance, a large majority (85.2%) of biomanufacturing facilities use single-use bioreactors in all stages of manufacturing (Fig. 1), yet the percentage of facilities that are using single-use bioreactors has not changed since 2020 (84.3%), according to the bioprocessing experts surveyed in the BioPlan study. The plateau is a natural progression as the market matures and companies fully integrate these technologies into their operations.

Newer SUS solutions such as membrane adsorbers have seen higher growth rate (9.6%) but less usage (67.5%). Since 2006 membrane usage has increased more than 50% due to widespread acceptance of its benefits in SUS. While the initial benefits drive rapid adoption, the long-term growth is tempered by considerations of process suitability, regulatory requirements, cost, supply chain reliability, and environmental impact. Continuous innovation and improvement in single-use technologies will be essential to address these challenges and sustain growth in the biopharmaceutical industry.

Fig 1: Applications in biopharmaceutical manufacturing: percent of respondents using single-use bioreactors in all stages of R&D or manufacture (2006-24)

Top 5 Advantages Of Implementing New SUS In Bioprocessing

Our annual report has measured how single-use technologies have transformed bioprocessing over the past 21 years. Most of these factors are well recognized by the industry and focus on boosting manufacturing efficiency and reducing costs. These benefits have become increasingly evident over the years leading to high market penetration. Some of the advantages identified include:

- Fast bioprocessing: SUS enable faster processing times, crucial for speeding up the development and production of biopharmaceuticals. Their rapid setup capabilities allow for swift adaptation to market changes.

- Cost savings: By minimizing the time to market, SUS help lower operational expenses. The disposable nature of these systems negates the need for extensive cleaning and validation, thereby saving on labor and materials.

- Adaptability/scalability: Production capacities with SUS can be quickly adjusted to respond to market demands. This flexibility is especially beneficial for small-scale or pilot productions, facilitating smooth transitions from R&D to large-scale manufacturing.

- Low risk of contamination: The disposable elements of SUS drastically reduce cross-contamination risks, enabling the production of multiple products in the same facility. Further, SUS streamline contamination control, cutting down on the need for rigorous quality checks, testing, and documentation.

- Low facility costs: Facilities using SUS can be smaller and economical to build and maintain. These systems are easier to implement, require less validation, and allow for quicker changeovers, enhancing overall operational efficiency.

As the industry evolves, SUS adoption is growing, driven by the need for efficient, cost-effective, and high-quality production solutions. For instance, in 2024, single-use bags (87.6%), connectors and clamps (87.6%), and tubing for disposable applications (86.6%) had more than 85% usage across facilities.

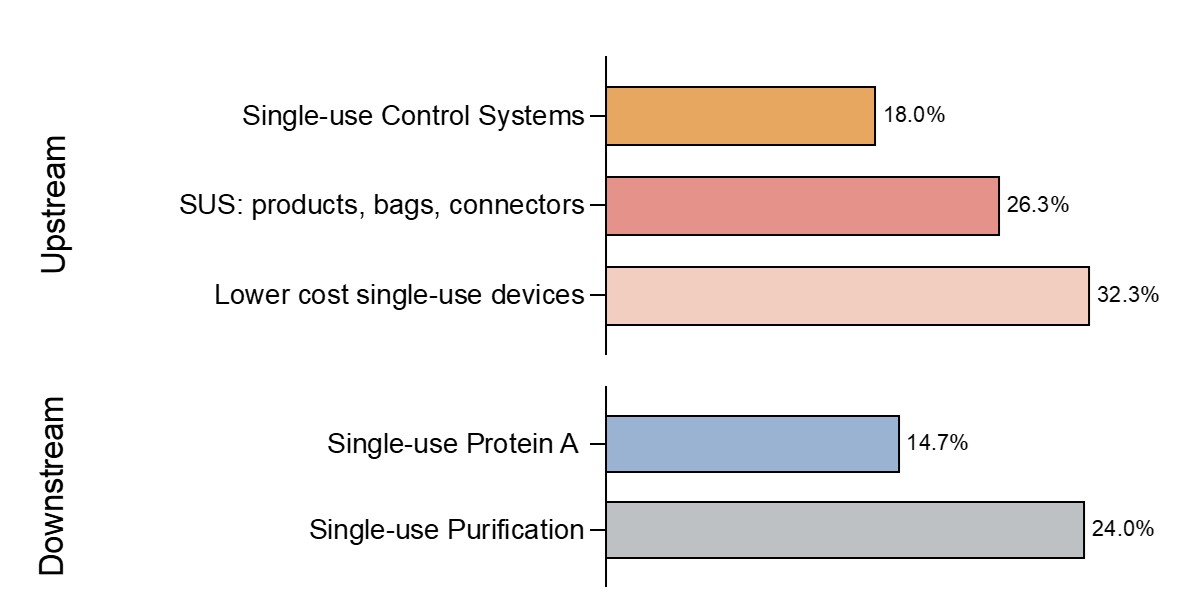

While SUS have undeniably enhanced bioprocessing, several ongoing challenges remain relevant in the industry. Over two-thirds of bioprocessing professionals demand further advancements, and more than 60% are dissatisfied with the cost of SUS. Upstream and downstream new SUS innovations are captured in BioPlan Associates' annual survey. Below are just a few of the dozens of areas identified where new product developments are being demanded.

Fig 2: Selected upstream/downstream new product development areas of interest in 2024

The highest percentage of survey responders, 32.3%, highlighted SUS cost as the top area they would like suppliers to concentrate their efforts. Other areas of focus related to SUS, include SUS bags, connectors (26.3%) and single-use control systems (18.0%). Interestingly, for downstream bioprocessing there were lower percentages of indicated improvements, in protein A chromatography (14.7%) and in purification (24.0%).

In addition to costs as the main challenge of SUS, we observe that often the SUS equipment in use, especially for processes such as purification, is an early-stage technology. Continuous innovation is vital for any new technology. Bioprocessing professionals note that progressing single-use purification systems has been slow. In 2010 bioprocessing professionals indicated about 35% of them want suppliers to focus on purification. The slight decrease denotes improvement but at a slower-than-desired pace. This can be attributed to the highly regulated nature of the bioprocessing industry.

Another significant concern is the environmental impact of the disposable nature of SUS, leading to increased plastic waste. The biopharmaceutical industry is actively seeking sustainable solutions, such as recycling programs and the development of biodegradable materials, to address this issue. Additionally, reliance on a few key suppliers for SUS components can pose risks, as evidenced during the COVID-19 pandemic when supply chains were disrupted. To mitigate these risks, companies are exploring strategies like diversifying suppliers and increasing stockpiles of critical components.

Overall, biomanufacturers need to significantly reduce operating costs and waste and boost post-sale profits. If these are achieved, we expect to see SUS being fully standardized and adopted to improve access to all biotherapies.

Modular Systems Are The Future Of SUS

Looking to the future, several trends are likely to shape the continued evolution of single-use systems in biopharmaceutical manufacturing. Innovations in material science are driving the development of more robust and versatile single-use components, such as gamma-stable and autoclavable materials, enhancing both durability and functionality. Additionally, the integration of SUS with digital monitoring and control systems is becoming more prevalent, enabling real-time monitoring of critical parameters and improving process control and product quality. The adoption of SUS also is expanding beyond traditional cell culture and fermentation processes to include downstream processing, such as filtration and chromatography.

Following the advancements in SUS, the bioprocess industry is focusing on modular bioprocessing units. These systems, featuring connectable, portable cleanrooms or isolator units, can be quickly assembled and become operational within weeks or months, offering similar benefits to SUS. The concept of "plug-and-play" factories, where entire production lines are easily replicable, is gaining popularity. Leading biopharmaceutical companies like Cytiva, G-Con, and Pharmadule are expanding modular bioprocessing units that integrate SUS within portable, self-contained units, trailers, or cleanrooms. In these setups, most of the equipment within the units is designed for single-use devices.

Fully SUS modular bioprocessing units are particularly attractive for applications such as epidemic vaccine production, especially when:

- Urgent and rapid response is required.

- There is estimated short-term demand.

- High safety standards are necessary.

- Quick setup of on-site facilities is needed.

As smaller continuous bioprocessing lines are introduced using more compact facilities, the opportunities for modular platforms in commercial manufacturing continue to expand. In 2024, we project a more than 5% increase in bioprocessing facilities evaluating upstream modular bioprocessing units in the next 12 months. This trend is expected to grow, providing more flexible, efficient, and scalable bioprocessing solutions.

While scaling up these modular facilities to meet rising global demand remains a complex challenge, the potential benefits are significant. Addressing issues such as maintaining consistent quality and regulatory compliance across multiple units, integrating diverse components, synchronizing and transporting modules, and ensuring seamless operation and communication between scaled-up units is essential.

The biopharmaceutical industry continues to grow and innovate, driven by advancements in single-use systems and modular bioprocessing units. These developments promise to enhance flexibility, efficiency, and scalability in biomanufacturing, meeting the industry's evolving needs and contributing to its positive future outlook.

About The Author:

Ioanna Deni is a contract market research scientist for BioPlan Associates. She is an experienced quantitative market research analyst with a Ph.D. in biomedical sciences and extensive experience in biopharmaceutical life science research. Her research background includes quantitative and qualitative market research expertise as an AI and healthcare specialist at Intelligence Ventures. Reach her at info@bioplanassociates.com, 301-921-5979. Learn more about BioPlan at www.bioplanassociates.com.

Ioanna Deni is a contract market research scientist for BioPlan Associates. She is an experienced quantitative market research analyst with a Ph.D. in biomedical sciences and extensive experience in biopharmaceutical life science research. Her research background includes quantitative and qualitative market research expertise as an AI and healthcare specialist at Intelligence Ventures. Reach her at info@bioplanassociates.com, 301-921-5979. Learn more about BioPlan at www.bioplanassociates.com.